Today, Tether Holdings Limited (BVI) released its assurance opinion for the fourth quarter of 2023, conducted by BDO, a globally renowned independent auditing firm. This attestation reaffirms the accuracy of Tether’s Consolidated Reserves Report (CRR) and provides a detailed breakdown of the assets held by the Group as of December 31, 2023.

In terms of financial performance, the fourth quarter witnessed a record-breaking net profit of $2.85 billion, of which ~$1 billion in net operating profits (were primarily interests from US Treasuries) with the remaining primarily from the appreciation of Gold and Bitcoin reserves. The excess reserves registered an all-time high increase of $2.2 billion totalling $5.4 billion, while the remaining $640 million was invested in various strategic projects (such as mining, AI infrastructure, P2P telecommunications and others). These are confirmed to remain outside of the consolidated reserves report within a new segregated VC umbrella, so that such investments don’t and won’t have any impact on the token reserves. At year end, the outstanding secured loans, which are collateralized by highly liquid assets as confirmed in the BDO attestation, are fully covered by the undistributed accumulated profits known as excess reserves ($4.8 billion in secured loans versus $5.4 billion of excess reserves).

Tether is proud to announce that it has achieved its goal of removing the risk of secured loans from the token reserves. While such secured loans are widely overcollateralized, Tether accumulated enough excess reserves to cover the entirety of the exposure. This is in response to the community’s past expressed concerns about this part of the portfolio.

Net profit for 2023 for the Group is $6.2 billion, of which ~$4 billion represented the net operating profits generated by US Treasuries, Reverse Repo and Money market funds while the rest was generated through the performance of other asset classes.

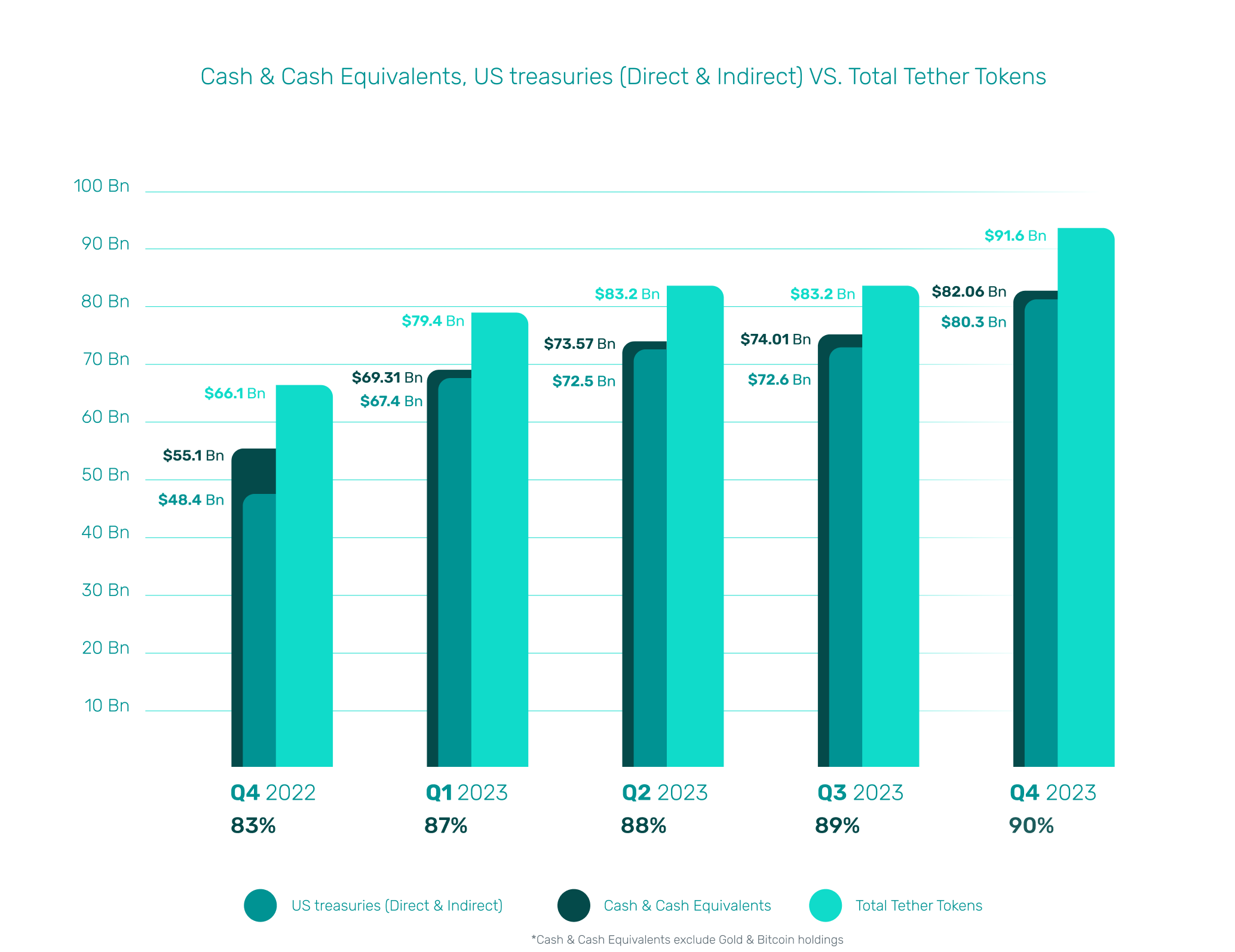

Tether also continued to experience positive contributions from all asset classes, notably in Gold, Bitcoin, and other investments. The Group achieved new record highs in both direct and indirect ownership of US Treasuries, with $80.3 billion exposure (where indirect exposure is calculated including overnight-reverse repos secured by US Treasuries, and money market funds invested in US Treasuries).

In line with the commitment to transparency and stability, Tether issued tokens backed by Cash and Cash Equivalent at an impressive 90%, emphasizing its dedication to maintaining liquidity within the stablecoin ecosystem.

The Consolidated Reserves Report (CRR) reiterates Tether's strong financial position, with consolidated assets surpassing consolidated liabilities.

The Management of the Company asserts the following as of 31 December 2023:

-

The Group’s consolidated total assets amount to at least US$ 97,020,394,556

-

The Group’s consolidated total liabilities amount to US$ 91,597,732,663 of which US$ 91,572,956,801 relate to digital tokens issued.

-

The Group’s consolidated assets exceed its consolidated liabilities.

-

Tether Group is not considering a part of its reserves backing the issued token the investments made into sustainable energy, Bitcoin mining, data, AI infrastructure,P2P telecommunications technology and other long term proprietary investments. During Q4 2023, investments made into these fields reached US$ $642’551’135 (USD 1’452’205’608 since beginning of the year).

The chart below shows that, as of 31 December 2023, Tether accumulated $5.4 billion in excess reserves, fully covering the outstanding ~$4.8 billion in secured loans included in the USD₮ reserves.

The chart below shows the growth of US Treasuries and Cash and Cash Equivalent versus total outstanding Tether Tokens.

Paolo Ardoino, CEO of Tether, emphasized, "Tether’s Q4 attestation underscores our commitment to transparency, stability, and responsible financial management. Achieving the highest percentage of reserves in Cash and Cash Equivalents reflects our dedication to liquidity and stability. The substantial net profits generated not only in the last quarter of the year but throughout the year, amounting to $6.2 billion, showcases our financial strength. Furthermore, our investments in sustainable energy, Bitcoin mining, data, AI infrastructure, and P2P telecommunications technology illustrate our commitment to a more sustainable and inclusive financial future."

For further details, please refer to the latest assurance opinion and the Consolidated Reserves Report here.